Putting Decentralized Finance In The Pocket Of Millions

DeFi Has a Problem

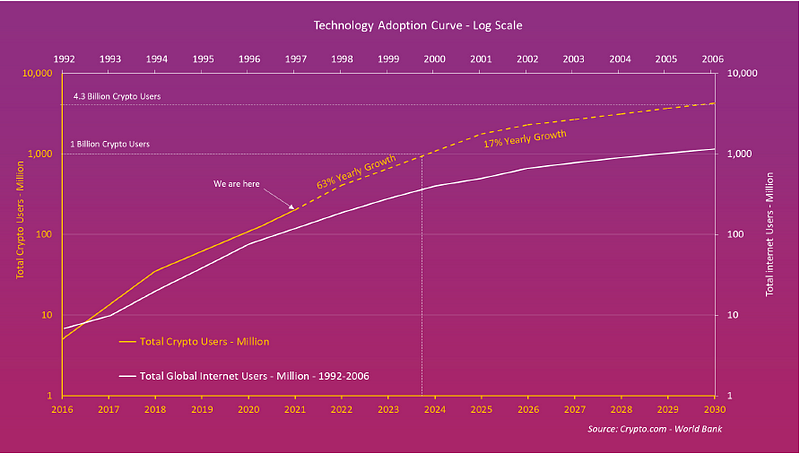

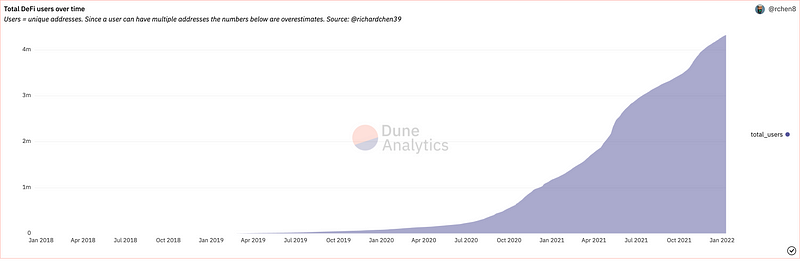

In 2017, over 11 million people worldwide were actively trading and investing in cryptocurrencies. It was this initial spark that would soon explode into over a 200 million active users by 2021. It is without a doubt one of the fastest growing and growing industries in the world. Growth we haven’t seen since the mass adoption of the internet.

Just like the internet, the initial products and utilities being developed currently have focused on building the blocks necessary for future mass adoption. Companies are creating incredible smart contracts to help crypto enthusiast manage their funds, earn yields, and transact in a truly decentralized manner.

But these products are mainly being adopted only by users who are tech inclined, and well versed in the field. There is an obvious gap between majority of crypto users, and users who understand DeFi. Unless this gap is bridged, it can be detrimental to the mass adoption of the most unique aspects of crypto…

Even though there are over a 200 million crypto traders worldwide, less than 2% have utilized services like Uniswap, Compound, and other decentralized smart contracts.

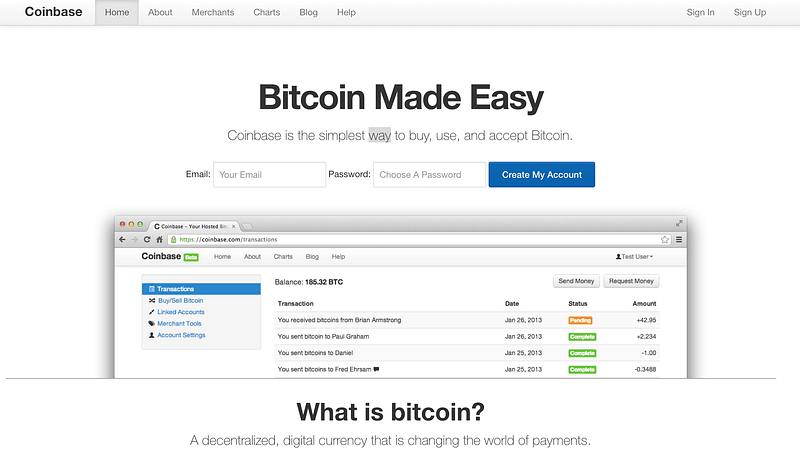

The problems are obvious. At the core of it is the severely lacking user experience in DeFi. These were some of the same problems plaguing non-DeFi crypto in the early days.

- Fiat to Crypto on-ramps were almost nonexistent.

- Fees ate into majority of your investment.

- Exchanges spent more time on listing tokens and cashing checks, than on ease of use.

- Local wallet storage led to massive losses to investors from HD crashes, data wipes, etc..

- And much more.

But companies, such as Coinbase, made investing in Bitcoin, Ethereum and other original tokens as easy as clicking one button. Instead of reinventing the wheel, they simply bridged the gap by making experience user friendly.

But CeFi Also Has A Problem

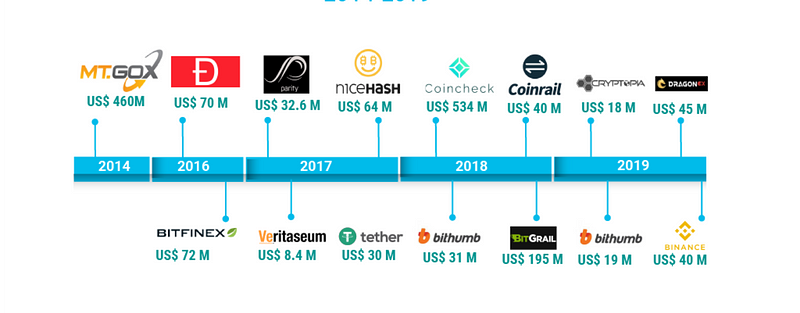

Over the past several years, we’ve seen billion of dollars lost by centralized authorities to hackers. Centralized exchanges will always be a prime target for hackers, and with rapidly expanding codebases, it’s extremely difficult for them to prevent a variety of attacks.

Not just that, but without proper regulatory bodies and audits, these companies have free rein on using your funds to create over-leveraged markets. Theoretically, a company could possess just $5 in liquid funds but allow trading of millions of dollars because there is 0 accountability.

To give you an example, when a user leverages an order, they are essentially borrowing funds from other users on the platform. But do those funds actually exist? The centralized exchange could simply update a few 1s and 0s on the backend and allow margin trading even though they are completely illiquid.

The same exact situation has happened even in the traditional financial systems where banks loaned out capital without any safety nets against bank runs. Leading to collapses of the entire financial systems as seen during the infamous Black Tuesday of 1929.

This is where decentralization is supposed to shine. It’s supposed to prevent these scenarios by taking away control from centralized authorities and allowing users control over their funds. Creating markets that are always liquid. Not your keys, not your money.

Unfortunately, CeFi in crypto is a necessity right now because of the poor user experience of current decentralized systems.

But it’s obvious to see why DeFi has a higher potential. YOU control your destiny. The tokens are on YOUR computer or phone. If you so choose to, you could even destroy the tokens permanently.

DeFi allows you to interact directly with decentralized applications from your computer. There is no centralized authority to control your funds. Unlike centralized finance, you always own your funds. Even in the worst case scenario and a company’s website goes down, your funds are always safe on the blockchain.

It is by far the biggest positive of crypto, and the core concept for Bitcoin’s inception. It is one of the main reasons people purchased Bitcoin when it was worth less than a dollar. Centralized services are in essence the opposite of what crypto stands for.

But again, centralized service are much easier to use. Much easier than DeFi…. But not for long.

Fixing DeFi Using CeFi UX

Until 2019, the entire crypto field was rife with speculation and zero utility. Tokens pumping and dumping strictly on promises and without platforms. But decentralized finance has changed the game. Companies are now creating incredible products and utilizing smart contracts in unique ways to solve major issues in global finance.

But, being such a young field, DeFi comes with many problems. Problems that prevent mass public adoption and usage. If you’re one of the 4 million people who have utilized DeFi, you’ve probably experienced these issues:

- Expensive fees

- Failed transactions

- Honeypot tokens

- Head spinning amount of blockchains and DEXes requiring bridges

- Hacking and phishing scams

- etc..

Chances are, at some point, you’ve introduced your friends or family to crypto, probably people who don’t have the same tech understanding as you. And yet, it was very easy for them to sign up and invest using FTX, Binance, Coinbase or variety of other simple to use centralized exchanges.

But now, imagine having to explain wallets, gas fees, failed transactions, DEXes, smart contracts, multi-chains, and every other issue plaguing DeFi. It would be a never-ending conversation of frustration devolving into throwing your computer at the wall.

Unfortunately, fixing these issues aren’t an easy task but it can be done. Aurox will be making it a priority this year to make DeFi simple… Starting with Aurox Mobile.

Introducing Aurox Mobile — DeFi For The Masses

In 2022, Aurox Mobile will deliver DeFi in the hands of 200 million cryptocurrency users with a simple, and intuitive design.

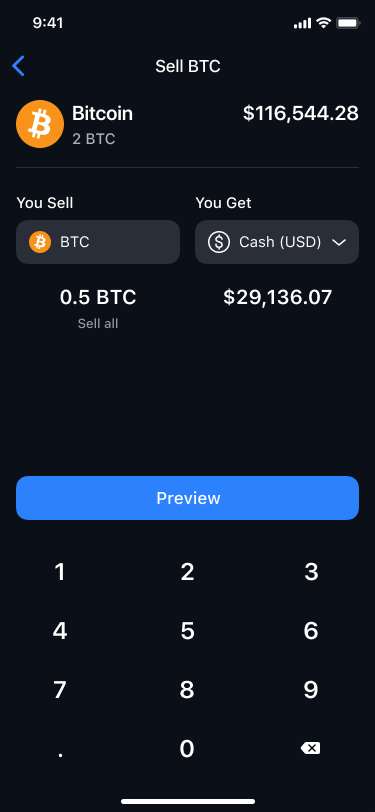

Our goal with the mobile application is to offset all the problems with DeFi to our own backend. The end user will be given a simple UI they’re familiar with to invest, trade, and take part in DeFi protocols with minimal effort.

Let’s breakdown just some of the ways Aurox Mobile will solve the problems plaguing DeFi.

All Major Compatible Chains Supported

Aurox Mobile will allow you to track and trade every single chain in existence. The first roll out of the application will include every EVM chain with non-EVM chains coming soon after the initial release.

But it’s not just that we’ll support all major chains, the user will be able to transact across the chains without having to even pay attention to which chain their funds are available on. More on this later.

Fiat On-Ramp/Off-Ramp

There are thousands of tokens available on decentralized exchanges, yet there is no easy way to purchase them. You’re forced to go to a centralized exchange, purchase stable coins, transfer it to a wallet, and then finally be able to purchase the token.

With Aurox Mobile, that’s a thing of the past. Simply link your debit card or bank, pick any token and buy directly using Fiat.

No More Gas

Every single one of you have experienced this issue. Going to Uniswap to purchase a token using a stable coin, only to realize you have no ETH to pay the gas fee. Then having to purchase ETH, send the ETH to your wallet and end up paying an additional $50 to $100 just to use your stable coin to execute a swap.

Is the current DeFi solutions ready for mainstream audience? Absolutely not.

With Aurox Mobile, you will no longer have to worry about keeping ETH, Matic or any other blockchain based token in your wallet to transact. Easily swap USDC to URUS with a click of a button.

Our solution to this problem will be unlike others. There’s already been progress made by other companies to eliminate this issue, but they’re heavily limited. Trust us, we explored every single option out there and none of them were truly “gas-free”. Every single current solution either has limitations on tokens supported, or requires at least some initial ETH to transact.

Aurox Mobile will have a complete gas-free experience. No user will ever require ETH, Matic, or any other blockchain token to transact.

Eliminating Failed Transactions

Failed transactions can’t happen. Period. If Aurox Mobile is to be utilized by even your parents, failed transactions are not acceptable. There’s several ways Aurox will be tackling this issue.

- Optimizing the slippage and gas limits to significantly reduce any failures.

- Utilizing MEV protection within the order routing contracts.

- In the very rare cases where the transaction fails anyways, the contract will immediately replace the order and pay for the network costs using our own funds.

Again, failed transactions are unacceptable. It’s impossible to explain to someone who has relied on centralized exchanges as to why their transaction didn’t go through and they lost money just for attempting it. The average crypto user isn’t aware that the blockchain can reject transactions, and we’ll keep it that way.

In the very rare cases when transactions still fail, our company is willing to use our own funds to replace the order and pay for the network fees ourselves. Think of it as an insurance policy. Retaining as many users as possible will require some monetary sacrifices on our end, but in the end, we’ll create a dedicated, long term and happy customer base.

Cross-Chain Trading

Another major problem with usability is having to explain bridges and multiple blockchains to non-DeFi users. It is the BIGGEST problem in DeFi and there’s multiple companies working on a multitude of different solutions to this problem.

Our solution is simple, the user will be able to select any token, on any chain, and use it to purchase any other token. On top of that, our routing contracts will automatically route to the cheapest available chain.

1 ETH = 1 ETH. Independent on which major chain the Ethereum is located on.

Therefore, when the user purchases ETH, our smart routing protocol will determine the cheapest chain for the user. Not only will it save the user significant fees, it will also find the cheapest priced ETH across all the networks.

Think of it as a blockchain aggregator.

This is by far the most powerful functionality and it will completely eliminate the need for the user to pay attention to blockchains. With cross-chain aggregation, the frontend UI will look and feel like the centralized exchanges they’re used to.

Accomplishing this goal requires significant development. It’s been under development for months, and we’re getting closer to accomplishing it. We’re hoping to release this function along with the MVP, but it’s possible we’ll be forced to release Aurox Mobile first without this function, and then quickly add it behind the scenes.

Simple and Easy to Use UI

We’ve created an UI that makes it simple to transact on DEXes. The application, smart contract and the backend will handle everything else for the user.

You’ll be able to view:

- A simple chart (or a full fledged TradingView chart with Aurox Indicators)

- Meta information such as website, social media, project info, etc..

- Quick stats such as holders, market cap, liquidity, etc..

- News

But even more so, you’ll be able to quickly search through curated lists of tokens via our tag system. For example, the tag system will allow you to filter coins based on:

- Newly listed

- Trending

- High volumes

- Fast holder increase

- Protocol categories

- etc.

The goal of our simplified UI is to cut out all the mess of dealing with DEXes and allow you to search, tap, and invest in your favorite tokens.

When Release

We’ve been actively developing the smart contracts and the mobile application for the past few months now. We’re expecting the beta release within the next few months. The beta will be invite only for our current users, and will help us iron out any kinks.

Aurox has always taken a stance to avoid setting exact deadlines because it leads to either disappointment or being forced to release a buggy product. As you may know, development can be unpredictable, everyone has seen time and time again that delays can happen.

However, we are actively hiring aggressively to release the application before the end of this quarter. Now that the cat’s out of the bag, we’ll be on strict deadline to release the product as soon as possible.

Tying It Into Aurox Terminal

All the functionalities discussed above will also be available within the terminal, but at a later date.

Our terminal is going through a major UX redesign to accommodate these functionalities as well as much more. Once the UX has been significantly improved, these same contracts will be integrated into the terminal.

Stay Tuned

This is just a glimpse of what’s the come within the Aurox ecosystem. There are significantly more functionalities coming for both the Mobile application and the Terminal. We’ve been extremely broad discussing some of the functions above on purpose, and we have a lot more surprises in store!

We’re just scratching the surface.